Burj Khalifa’s Blueprint for Success : Unlocking the Business Secrets of the World’s Tallest Icon

Business Case Study Series

Burj Khalifa: A Comprehensive Business Case Study

1. Introduction

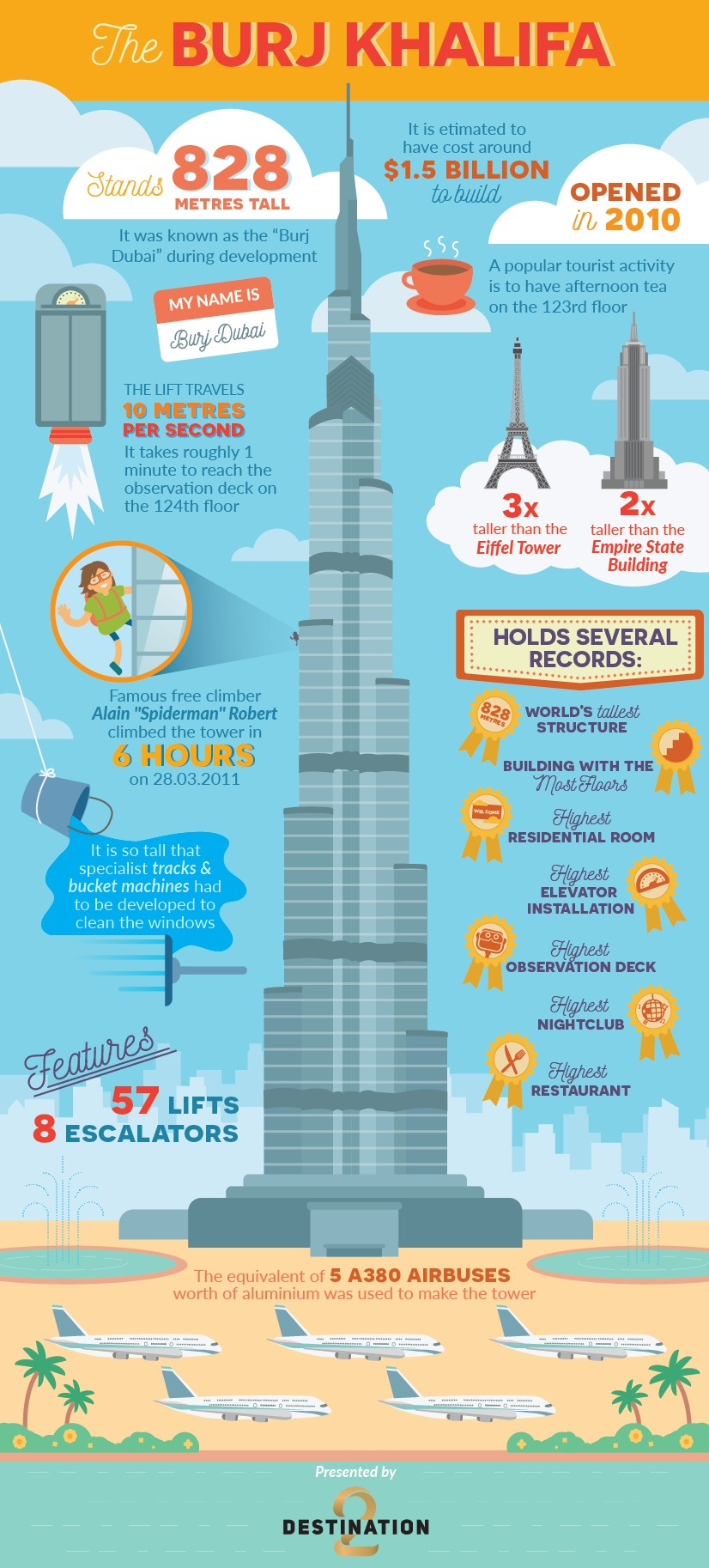

Burj Khalifa, the tallest structure in the world, stands as a symbol of architectural and engineering excellence. Opened in 2010 in Dubai, UAE, this iconic building represents Dubai's ambitions to become a global hub for tourism, commerce, and luxury living. This case study explores Burj Khalifa’s business model, its significance to the city’s economy, and the challenges and strategies in maintaining its world-class status, providing valuable insights for Home School of Business students.

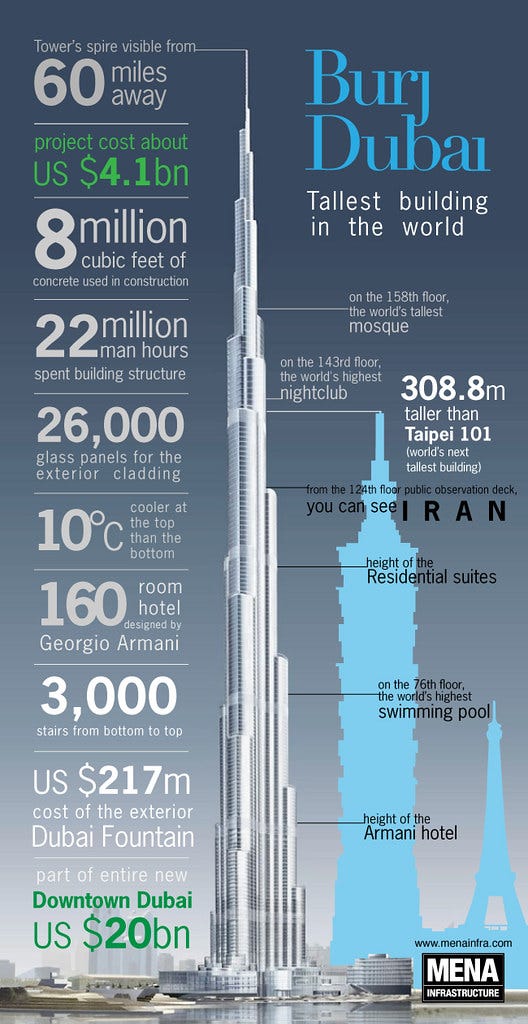

2. Project Overview

Location: Dubai, United Arab Emirates

Developer: Emaar Properties

Height: 828 meters (2,717 feet)

Completion: January 2010

Architect: Adrian Smith (Skidmore, Owings & Merrill)

Investment: Approximately $1.5 billion

Usage: Mixed-use (residential, commercial, hospitality, and observation deck)

Features: 163 floors, luxury apartments, office spaces, Armani Hotel, and the world’s highest observation deck

3. Market Analysis

Dubai’s Real Estate Market: Dubai’s property market has been characterized by rapid growth, driven by a burgeoning economy, high oil prices, and government-backed infrastructure initiatives. The city has become a global destination for luxury real estate and tourism, and Burj Khalifa plays a key role in sustaining this image.

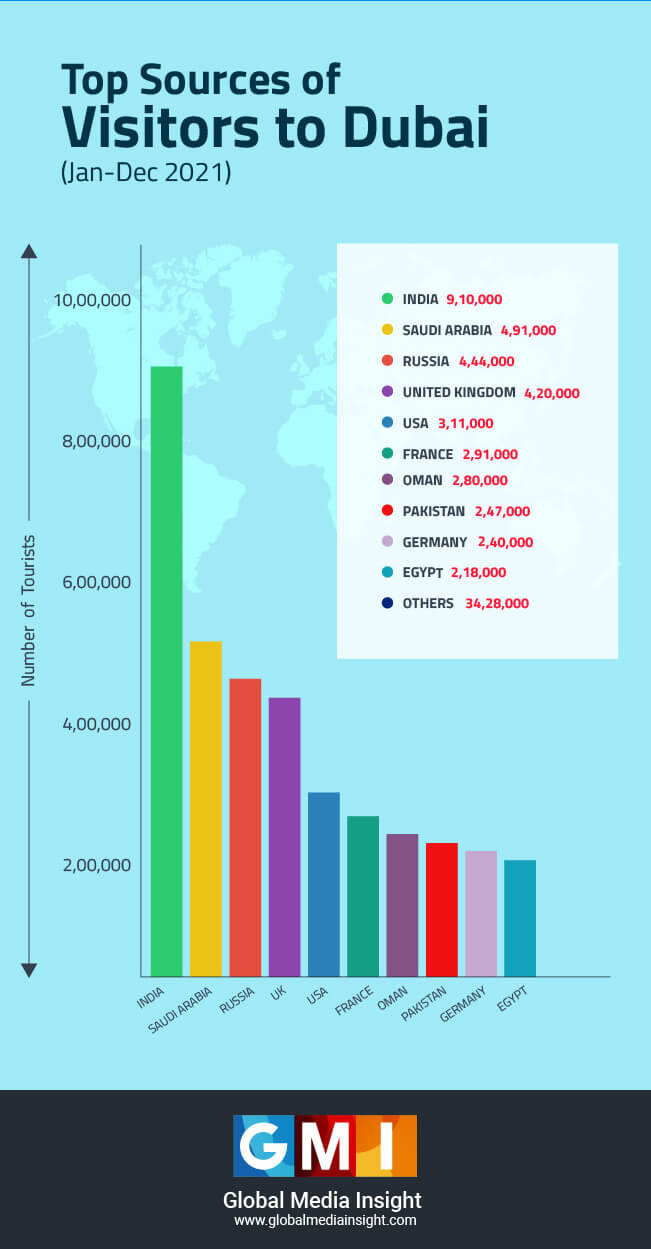

Tourism and Commerce: Burj Khalifa is not just a building but a major tourist attraction, drawing millions annually. Its presence enhances Dubai's image as a luxury travel destination, boosting retail, hospitality, and entertainment sectors.

Competitive Landscape: While other skyscrapers like the Shanghai Tower and Abraj Al-Bait Clock Tower are formidable in height and stature, Burj Khalifa retains its unique selling proposition due to its unmatched height and luxury offerings.

4. Business Model

The Burj Khalifa operates under a multi-faceted business model, combining luxury real estate, tourism, hospitality, and commercial spaces to generate revenue streams.

Real Estate Sales: Luxury residential apartments, commercial offices, and branded residences (such as the Armani Hotel) generate significant revenue.

Tourism Revenue: Millions of visitors annually pay to visit the At the Top observation deck, dining outlets, and various other attractions inside Burj Khalifa.

Hospitality: The Armani Hotel occupies 11 floors, adding a layer of exclusive luxury and contributing to hospitality-driven income.

Corporate Tenants: Burj Khalifa houses numerous multinational corporations, offering premium office spaces with world-class amenities.

Events and Sponsorships: The building hosts high-profile events, including the globally renowned New Year's Eve fireworks, which further drive revenue and brand positioning.

5. Evolution and Development

Early Vision: In the early 2000s, Dubai set forth a vision to create a landmark that would shift global focus toward the city. Burj Khalifa was conceived as a center of luxury and economic growth.

Construction Milestones: Construction began in 2004, using advanced engineering techniques to support the extraordinary height and unique Y-shaped floor plan, optimized for residential and office spaces.

Opening: The tower opened in January 2010 amid global fanfare, serving as a beacon of Dubai’s ambition to become a world leader in tourism, luxury, and commerce.

6. Operational Strategy

Vertical Integration: Emaar Properties, the developer, operates most aspects of the Burj Khalifa complex, from real estate sales to retail and hospitality management.

Maintenance and Sustainability: The structure is maintained using cutting-edge technologies for air conditioning, window cleaning, and energy conservation. There is a heavy focus on long-term sustainability, including efficient water usage and energy management strategies.

Digital Presence: Burj Khalifa’s marketing and customer engagement strategies heavily rely on digital platforms, with a strong social media presence, ticketing apps, and virtual reality experiences to drive global tourism interest.

7. Financial Analysis

Revenue: Burj Khalifa generates income from multiple sources, including real estate sales (both residential and commercial), hospitality (hotel and serviced apartments), tourism (observation deck and events), and corporate leases.

Costs: Significant costs include construction, maintenance, security, and operational expenses for high-tech maintenance systems.

Return on Investment (ROI): Despite its high construction cost, the tower has been a profitable investment for Emaar Properties, generating substantial returns from property sales, leases, and tourism.

8. Marketing and Customer Acquisition

Target Market: Ultra-high-net-worth individuals (UHNWI), international tourists, multinational corporations, and global luxury brands.

Marketing Channels: Digital marketing, partnerships with global travel agencies, and leveraging Dubai’s status as a major travel and commerce hub.

Brand Collaborations: Collaborations with high-end luxury brands like Armani for the hotel and fashion boutiques to elevate the status of Burj Khalifa as a world leader in luxury.

Events: The building frequently hosts high-profile global events, such as the annual New Year's Eve fireworks, cementing its status as a top destination for international events.

9. Challenges

Sustainability: Managing a building of such scale and luxury in a desert climate poses significant sustainability challenges, particularly regarding energy consumption and water usage.

Maintenance Costs: The operational and maintenance costs for the world's tallest building are immense, requiring sophisticated technology for cleaning and repairs.

Economic Volatility: The profitability of luxury real estate and tourism can be heavily impacted by global economic downturns, geopolitical tensions, or pandemics such as COVID-19.

Intense Competition: Dubai's real estate market is highly competitive, with newer developments offering competitive alternatives.

10. COVID-19 Impact

Tourism Decline: The pandemic led to a sharp decline in tourism, significantly impacting revenue from observation deck visits and hospitality operations.

Commercial Leasing: Corporates occupying premium office spaces in Burj Khalifa faced disruptions due to remote work trends, leading to temporary vacancies or downsizing.

Recovery Strategy: Emaar Properties accelerated its digital transformation and launched campaigns targeting local and regional tourists to boost occupancy and revenue post-pandemic.

11. Future Prospects

Tourism and Events: With global tourism expected to recover, Burj Khalifa aims to re-establish itself as a top global destination through marketing campaigns and hosting large-scale events.

Sustainability Initiatives: There is a growing emphasis on improving the tower’s energy efficiency and reducing its carbon footprint to align with Dubai’s green building standards.

Expansion of Experiences: Plans for enhancing the tourist experience with immersive technology, virtual tours, and integrating smart building technologies are in place to sustain the attraction’s appeal.

12. SWOT Analysis

Strengths:

World's tallest structure, globally recognized.

Multiple revenue streams from real estate, tourism, hospitality, and events.

Prime location in one of the world’s most luxurious cities.

Weaknesses:

High operational and maintenance costs.

Heavy reliance on tourism and luxury real estate, making it vulnerable to economic downturns.

Opportunities:

Expansion of tourism with emerging travel trends post-pandemic.

Enhancing sustainability efforts to reduce operating costs and appeal to environmentally conscious investors.

Threats:

Economic slowdowns, particularly in the real estate market.

Increasing competition from new high-end real estate projects in Dubai and globally.

13. Strategic Recommendations

Enhance Sustainability Efforts: Invest in energy-efficient technologies to reduce the long-term operational costs of maintaining such a large structure.

Diversify Tourism Offerings: Create new tourism experiences, such as virtual reality tours and partnerships with global luxury brands, to increase footfall and attract new demographics.

Focus on Digital Transformation: Improve the digital engagement of potential tourists and residents through AR/VR and personalized services, making Burj Khalifa’s experiences more immersive and exclusive.

Leverage Global Events: Continue using Burj Khalifa as a backdrop for global events and media to maintain its status as an iconic landmark and luxury hub.

14. Conclusion

Burj Khalifa has not only become a symbol of Dubai's ambitious growth but also a key driver of the city's economy through tourism, real estate, and corporate tenants. By continuously innovating in terms of sustainability and digital engagement, Burj Khalifa is well-positioned to remain a leading landmark in the global luxury space. This case study offers Home School of Business students valuable insights into the strategic and operational aspects of managing such a world-class asset.

HSB Important Articles and References :Share your feedback and tell us which case studies you'd like to see next by filling out this quick Google form! Click Here

Check and follow up:

1) WhatsApp Channel : Click Here

2) Instagram : https://www.instagram.com/homeschoolofbusiness.in/

Burj Khalifa (Wikipedia) : Click Here

Book a visit : Click Here

The Architecture : Click Here

Case Study Analysis (Research Paper) : Click Here

What is inside Burj Khalifa : Click Here

EMAAR Financial Report : Click Here

THE Armani Hotel in Burj Khalifa : Click Here

HSB Video Vault :-

What The Home School of Business Offers:

Business News Letters We Offer:

Business Case Study Series, Scam Series, Leadership Series, Industry Series, City Series, 5 Minute reads.

Your journey from an idea to IPO starts here!

Visit our website for all Posts: CLICK HERE

Best Regards,

The Home School of Business Team