How Does London Maintain Its Status as a Global Powerhouse?

Discover the Secrets Behind London’s Economic Resilience, Cultural Influence, and Future Potential!

Welcome to The Home School of Business!

100+ Posts | 16K+ Entrepreneurs

🚀Now Curated for General Public with more Visuals & Infographics.

Our Mission: Unlocking the secrets of businesses, brands, leaders, and more to inspire entrepreneurs everywhere.

The Home School of Business Website

💬Join our WhatsApp Channel (In a hurry? We’ve packed the highlights of the article right here, paired with the latest breaking news you can’t afford to miss.)

Check out the Quick Summary Insights & Top News Headlines on our Instagram

✨ Experience Home School of Business Podcasts on Spotify Today!

📲 Tap here to open Spotify and enjoy our latest episodes!

Why You'll Love Us:

London: A Case Study in Global Influence and Economic Resilience

London: A Comprehensive Business Journey

In the ever-evolving and competitive landscape of global commerce and finance, London stands out as a powerhouse of economic activity and innovation. From its historical roots as a trading hub to its current status as a leading global financial center, London has consistently demonstrated resilience, adaptability, and strategic foresight. This article delves into London’s remarkable business journey, decoding its success and challenges through a comprehensive lens while maintaining an engaging and accessible narrative for the general reader.

Founding Story: From Ancient Trade Hub to Modern Metropolis

London’s strategic location along the River Thames has been pivotal to its development as a major trading hub since Roman times. Established as Londinium in AD 43, London quickly became a center for commerce and governance. Over the centuries, the city expanded its influence through maritime trade, colonization, and industrialization.

Key Historical Milestones:

Roman Era (AD 43): Foundation of Londinium as a trading post and administrative center.

Medieval Period: Growth as a center for wool trade and craftsmanship.

17th Century: Establishment of the Bank of England (1694), laying the groundwork for financial services.

Industrial Revolution (18th-19th Century): Expansion of industries, infrastructure, and global trade networks.

20th Century: Transformation into a global financial hub with the rise of the City of London.

21st Century: Emphasis on technology, innovation, and sustainability, reinforcing London’s position in the global economy.

London’s evolution from a modest trading post to a sprawling metropolis underscores its enduring capacity to adapt and thrive amidst changing economic landscapes.

History and Milestones: A Journey of Expansion and Diversification

London’s business landscape is marked by significant milestones that highlight its expansion and diversification across various sectors:

1600: Establishment of the London Stock Exchange, becoming a cornerstone of global finance.

1801: Opening of the London Metal Exchange, cementing the city’s role in commodities trading.

1986: Deregulation of the financial markets (Big Bang), transforming the City of London into a leading financial center.

2000s: Growth of the technology and creative industries, diversifying the economic base.

2016: Brexit referendum, introducing new dynamics in trade, finance, and regulatory frameworks.

2020-2025: Post-Brexit adjustments and the rise of fintech, propelling London into new realms of innovation.

These milestones reflect London’s strategic expansions, adaptability to global economic shifts, and its ability to leverage emerging opportunities for sustained growth.

Rapid Growth: Leadership and Strategic Execution

London’s rapid ascent as a global economic leader is attributed to visionary leadership, strategic initiatives, and a conducive business environment. Key factors driving this growth include robust financial infrastructure, innovation ecosystems, and a diverse talent pool.

Key Strategies Behind Rapid Growth:

Financial Services Excellence:

Banking and Insurance: Home to major global banks, insurance companies, and investment firms.

Capital Markets: Leading hub for bond issuance, equity trading, and derivatives markets.

Innovation and Technology:

Fintech Revolution: Pioneering advancements in financial technology, blockchain, and digital payments.

Tech Hubs: Growth of Silicon Roundabout and Tech City, fostering startups and tech enterprises.

Global Connectivity:

Transportation Infrastructure: World-class airports (Heathrow, Gatwick) and extensive public transit systems facilitating international business.

Trade Networks: Strong global trade links through historical ties and modern logistics capabilities.

Talent and Education:

Top Universities: Institutions like Imperial College London, London School of Economics, and University College London producing skilled graduates.

Diverse Workforce: Multicultural and multilingual talent pool attracting businesses from around the world.

Regulatory Environment:

Business-Friendly Policies: Favorable tax regimes, ease of doing business, and supportive regulatory frameworks.

Financial Regulation: Robust regulatory bodies ensuring market stability and investor confidence.

London’s strategic execution in these areas has established it as a premier destination for business and investment, fostering an environment where enterprises can flourish.

Mission and Vision: Shaping Success and Influence

London’s overarching mission revolves around maintaining its status as a leading global economic center, fostering innovation, and promoting sustainable growth. The city’s vision extends beyond financial prowess, aiming to create an inclusive, resilient, and forward-thinking metropolis.

Core Values:

Innovation: Encouraging cutting-edge developments and technological advancements.

Diversity: Embracing multiculturalism and fostering an inclusive business environment.

Sustainability: Committing to environmentally responsible practices and green initiatives.

Resilience: Building economic and infrastructural resilience to withstand global challenges.

Collaboration: Promoting partnerships between government, businesses, and academia.

Impact Goals:

Economic Leadership: Sustaining and enhancing London’s role in global finance and commerce.

Social Responsibility: Supporting community development, education, and social welfare programs.

Environmental Stewardship: Implementing sustainable practices across industries and urban planning.

Cultural Influence: Leveraging London’s rich cultural heritage to enhance its global image and attract talent.

London’s mission and vision encapsulate its dedication to building a dynamic, sustainable, and influential economic landscape that benefits both businesses and the broader community.

Products and Services: Beyond Finance

While financial services remain a cornerstone of London’s economy, the city boasts a diverse array of industries and services that contribute to its robust business ecosystem.

Flagship Offerings:

Financial Services:

Banking: Comprehensive services including retail, corporate, and investment banking.

Insurance: Diverse insurance products catering to individuals and businesses.

Asset Management: Managing investments for institutions and high-net-worth individuals.

Technology and Innovation:

Fintech Solutions: Digital banking, payment platforms, and blockchain technologies.

Tech Startups: Incubators and accelerators fostering innovation in various tech sectors.

Creative Industries:

Media and Entertainment: Thriving sectors including film, television, publishing, and advertising.

Design and Fashion: Renowned for its influential design studios and fashion houses.

Real Estate and Construction:

Commercial Real Estate: Office spaces, retail properties, and industrial facilities.

Residential Developments: High-end apartments, housing projects, and sustainable living spaces.

Professional Services:

Legal and Consulting: Top-tier law firms, management consultants, and advisory services.

Accounting and Audit: Comprehensive financial auditing and accounting services.

Customer Benefits:

London’s diverse offerings provide businesses and consumers with a wide range of services that ensure high quality, innovation, and reliability. Customers benefit from the city’s cutting-edge financial products, technological advancements, and vibrant creative scene, all supported by a robust infrastructure and a skilled workforce.

Market Position and Competition: Leading with Influence

In the highly competitive global economy, London has carved out a unique position through its strengths in financial services, innovation, and cultural influence.

Industry Standing:

Global Financial Hub:

Competitors: New York City, Hong Kong, Singapore.

Competitive Edge: Deep financial expertise, extensive capital markets, and a global network of financial institutions.

Technology and Innovation:

Competitors: Silicon Valley, Berlin, Tel Aviv.

Competitive Edge: Strong fintech sector, supportive innovation ecosystems, and access to top talent.

Creative Industries:

Competitors: Los Angeles, Paris, Milan.

Competitive Edge: Rich cultural heritage, influential media presence, and a dynamic arts scene.

Real Estate:

Competitors: Dubai, Tokyo, Sydney.

Competitive Edge: Prime location, high demand for commercial and residential properties, and iconic landmarks.

Competitive Edge:

Strong Financial Infrastructure: World-class financial institutions and regulatory bodies.

Innovation Ecosystem: Thriving tech startups and robust support for research and development.

Global Connectivity: Excellent transportation and communication networks facilitating international business.

Diverse Talent Pool: Multicultural workforce with a wide range of skills and expertise.

Cultural Capital: Rich history and vibrant cultural scene attracting global talent and investment.

London’s ability to maintain its competitive edge across multiple industries underscores its strategic prowess and influential presence in the global market.

Business Model: The London Economy

London’s business model is multifaceted, integrating diverse sectors and fostering an environment conducive to innovation, investment, and sustainable growth.

Core Sectors:

Financial Services:

Banking and Investment: Comprehensive financial services for global markets.

Insurance and Asset Management: Diverse offerings catering to various financial needs.

Technology and Innovation:

Fintech: Leading advancements in financial technology and digital payments.

Tech Startups: Supportive ecosystem for emerging tech enterprises.

Creative Industries:

Media and Entertainment: Influential sectors shaping global media trends.

Design and Fashion: Renowned for its innovative design and fashion industries.

Real Estate and Construction:

Commercial and Residential: Extensive property developments and management.

Sustainable Building: Focus on eco-friendly and energy-efficient construction practices.

Professional Services:

Legal and Consulting: Top-tier services supporting various business needs.

Accounting and Audit: Comprehensive financial auditing and accounting.

Revenue Streams:

Financial Services Fees: Revenue from banking, investment, and insurance services.

Technology Solutions: Income from fintech products, software, and digital platforms.

Creative Outputs: Earnings from media, entertainment, and design industries.

Real Estate Transactions: Revenue from property sales, rentals, and management.

Professional Service Fees: Income from legal, consulting, and accounting services.

Target Market:

Global Corporations: Multinational companies seeking financial and professional services.

Tech Innovators: Startups and tech firms driving innovation and digital transformation.

Creative Professionals: Media, entertainment, and design industries shaping global trends.

Real Estate Investors: Individuals and businesses investing in commercial and residential properties.

Local and International Consumers: Diverse customer base benefiting from London’s wide range of services.

London’s integrated business model leverages its strengths across multiple sectors, creating a resilient and dynamic economy that attracts investment and fosters sustained growth.

Financial Analysis of London’s Economy

London’s economy demonstrates robust financial performance, marked by significant revenue generation, strategic investments, and a diversified economic base.

Economic Performance:

Gross Domestic Product (GDP) (2024): Approximately $800 billion

Growth Drivers: Financial services, technology and innovation, real estate, and creative industries.

Investment Highlights:

Financial Sector: Continues to attract substantial foreign direct investment (FDI) and global capital flows.

Technology: Significant investments in fintech, artificial intelligence, and digital infrastructure.

Real Estate: Ongoing developments in commercial and residential properties, including sustainable buildings.

Creative Industries: Growth in media, entertainment, and design sectors contributing to economic diversification.

Profitability:

Economic Resilience: Diverse sectors ensure stability and mitigate risks associated with sector-specific downturns.

High Value Additions: Financial services and technology sectors contribute significantly to GDP and export revenues.

Consistent Earnings: Steady income streams from real estate, professional services, and creative industries.

Revenue Streams:

Financial Services: 35%

Technology and Innovation: 25%

Real Estate: 20%

Creative Industries: 10%

Professional Services: 10%

Cost Structure:

Operational Expenses: 40-45%

Infrastructure Maintenance: Costs associated with maintaining transportation and communication networks.

Service Delivery: Expenses related to providing financial, tech, and creative services.

Investment in Innovation: 20-25%

R&D: Funding for research and development in technology and sustainable practices.

Capital Expenditures: Investments in new projects, buildings, and technological upgrades.

Marketing and Branding: 15-20%

Global Marketing: Efforts to promote London as a premier business destination.

Local Promotion: Initiatives to support local businesses and attract talent.

Administrative Expenses: 10-15%

Governance: Costs related to regulatory compliance and administrative functions.

Support Services: Expenses for legal, consulting, and professional services.

Profitability Metrics:

Gross Profit Margin: ~50-55%

Insight: Strong margins indicate effective cost management and high-value service offerings.

Operating Profit Margin: ~20-25%

Insight: Reflects robust operational efficiency and strategic investments.

Net Profit Margin: ~15-20%

Insight: Healthy net margins driven by diversified income streams and controlled expenses.

Return on Equity (ROE): ~18-22%

Insight: Demonstrates effective use of capital to generate profits.

Return on Assets (ROA): ~8-12%

Insight: Indicates efficient utilization of assets to generate income.

Key Financial Ratios:

Current Ratio: 1.3-1.6

Insight: Adequate liquidity to meet short-term obligations.

Debt-to-Equity Ratio: 0.7-1.0

Insight: Balanced leverage, indicating manageable debt levels.

Earnings Per Share (EPS): N/A

Insight: Not directly applicable as London’s economy encompasses multiple sectors and entities.

Trend Analysis:

GDP Growth: Steady 3-5% annual increase, driven by financial services, technology, and real estate.

Profit Margins: Improving through cost optimizations and strategic sectoral investments.

Capital Expenditures (CapEx): Increasing investments in infrastructure, technology, and sustainable projects.

FDI Inflows: Consistent growth in foreign direct investment, particularly in finance and tech sectors.

Comparison with Competitors:

GDP:

London: ~$800B vs. New York City: ~$1.5T, Tokyo: ~$1.6T, Singapore: ~$400B

Growth Rate:

London: 3-5% vs. New York City: 2-4%, Tokyo: 1-3%, Singapore: 4-6%

Financial Sector Contribution:

London: 35% vs. New York City: 40%, Tokyo: 30%, Singapore: 25%

Innovation Index:

London: Top 10 globally vs. New York City: Top 10, Tokyo: Top 15, Singapore: Top 10

Financial Challenges and Risks:

Brexit Impact:

Impact: Changes in trade agreements, regulatory frameworks, and talent mobility affecting businesses.

Market Volatility:

Impact: Fluctuations in financial markets can impact investment and economic stability.

Regulatory Changes:

Impact: Shifts in financial regulations, data protection laws, and environmental standards influencing operations.

Cost of Living:

Impact: High living costs can affect workforce availability and business expenses.

Global Economic Uncertainty:

Impact: International economic downturns can reduce trade and investment flows into London.

Future Financial Prospects:

Revenue Growth:

Projection: Continued expansion in financial services, technology, and real estate, with potential growth in green finance and sustainable investments.

Profitability Enhancements:

Strategies: Ongoing cost optimizations, strategic sectoral investments, and diversification into emerging industries.

Investment Focus:

Areas: Technology upgrades, sustainable infrastructure, and international market expansion.

Economic Resilience:

Commitment: Building a resilient economy through diversified sectors and strategic risk management.

Summary of Financial Health:

Strong GDP Growth: Driven by robust financial services, technology, and real estate sectors.

Healthy Profit Margins: Maintained through effective cost management and high-value service offerings.

Solid Investment Climate: Attracting substantial foreign direct investment and fostering economic diversification.

Balanced Debt Levels: Manageable leverage ensuring financial stability.

Resilient Economic Structure: Diverse revenue streams and strategic sectoral growth contributing to overall financial health.

London’s economy exhibits strong financial health, supported by diversified sectors, strategic investments, and a resilient infrastructure that underpins sustained growth and stability.

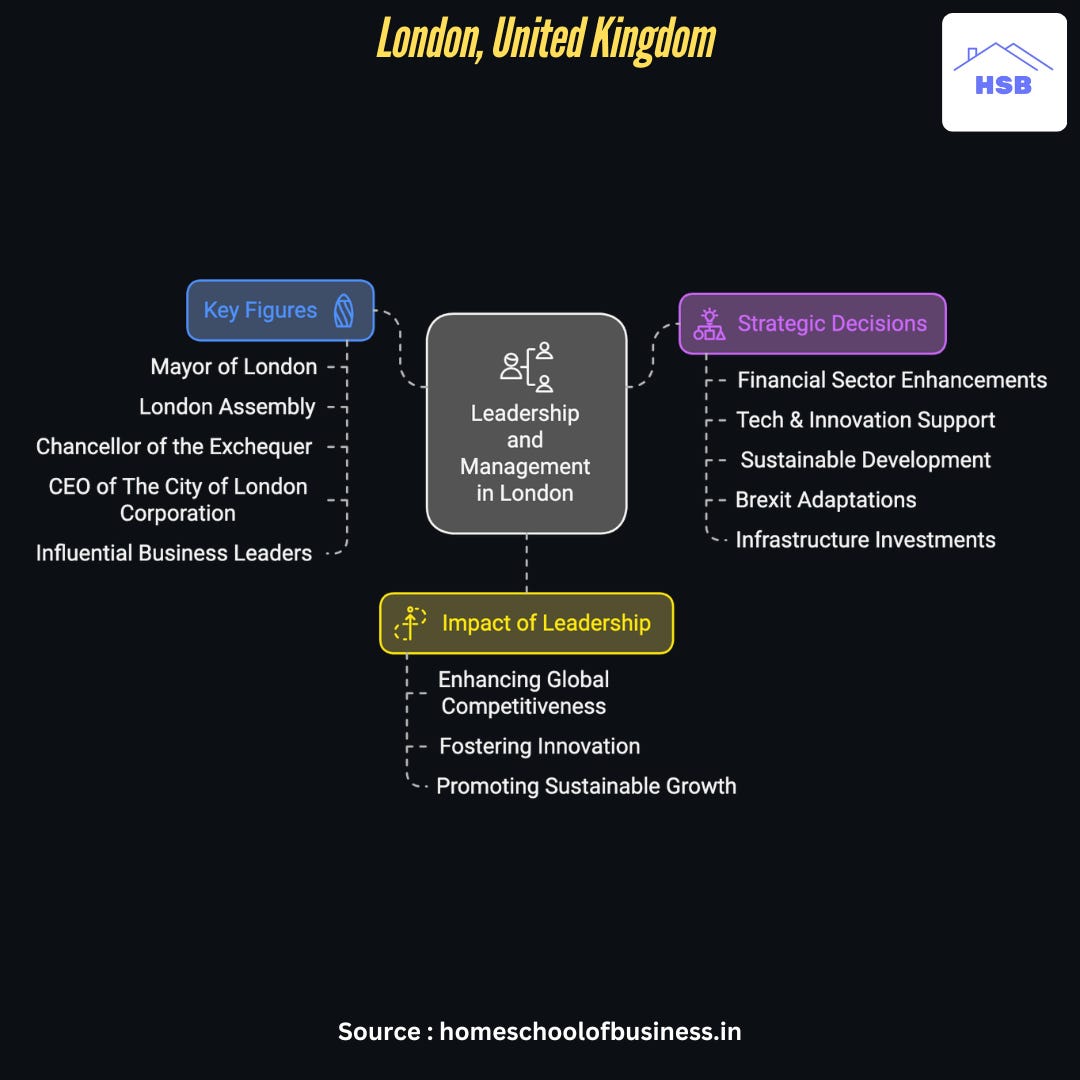

Leadership and Management: Visionary Guidance

London’s leadership landscape is characterized by a blend of visionary policymakers, influential business leaders, and innovative entrepreneurs. This leadership has been pivotal in steering the city’s economic trajectory and fostering a conducive environment for business growth.

Key Figures:

Mayor of London: Oversees the strategic development of the city, focusing on economic growth, infrastructure, and sustainability.

London Assembly: Provides scrutiny and oversight of the Mayor’s policies and initiatives.

Chancellor of the Exchequer: Manages the UK’s economic policy, impacting London’s financial sector.

CEO of The City of London Corporation: Manages the historic financial district, ensuring its continued prominence.

Influential Business Leaders: Heads of major financial institutions, tech companies, and creative enterprises driving innovation and economic growth.

Strategic Decisions:

Under London’s leadership, strategic decisions have focused on enhancing the city’s global competitiveness, fostering innovation, and promoting sustainable growth. Key initiatives include:

Financial Sector Enhancements: Implementing policies to attract and retain financial institutions, ensuring London remains a leading financial hub.

Tech and Innovation Support: Investing in tech infrastructure, incubators, and innovation hubs to support the growth of the technology sector.

Sustainable Development: Promoting green building practices, renewable energy projects, and sustainable urban planning.

Brexit Adaptations: Navigating post-Brexit challenges through strategic trade agreements, regulatory adjustments, and talent retention strategies.

Infrastructure Investments: Upgrading transportation networks, digital infrastructure, and public services to support business operations and quality of life.

London’s leadership has been instrumental in creating a dynamic and forward-thinking business environment, enabling the city to navigate challenges and seize emerging opportunities effectively.

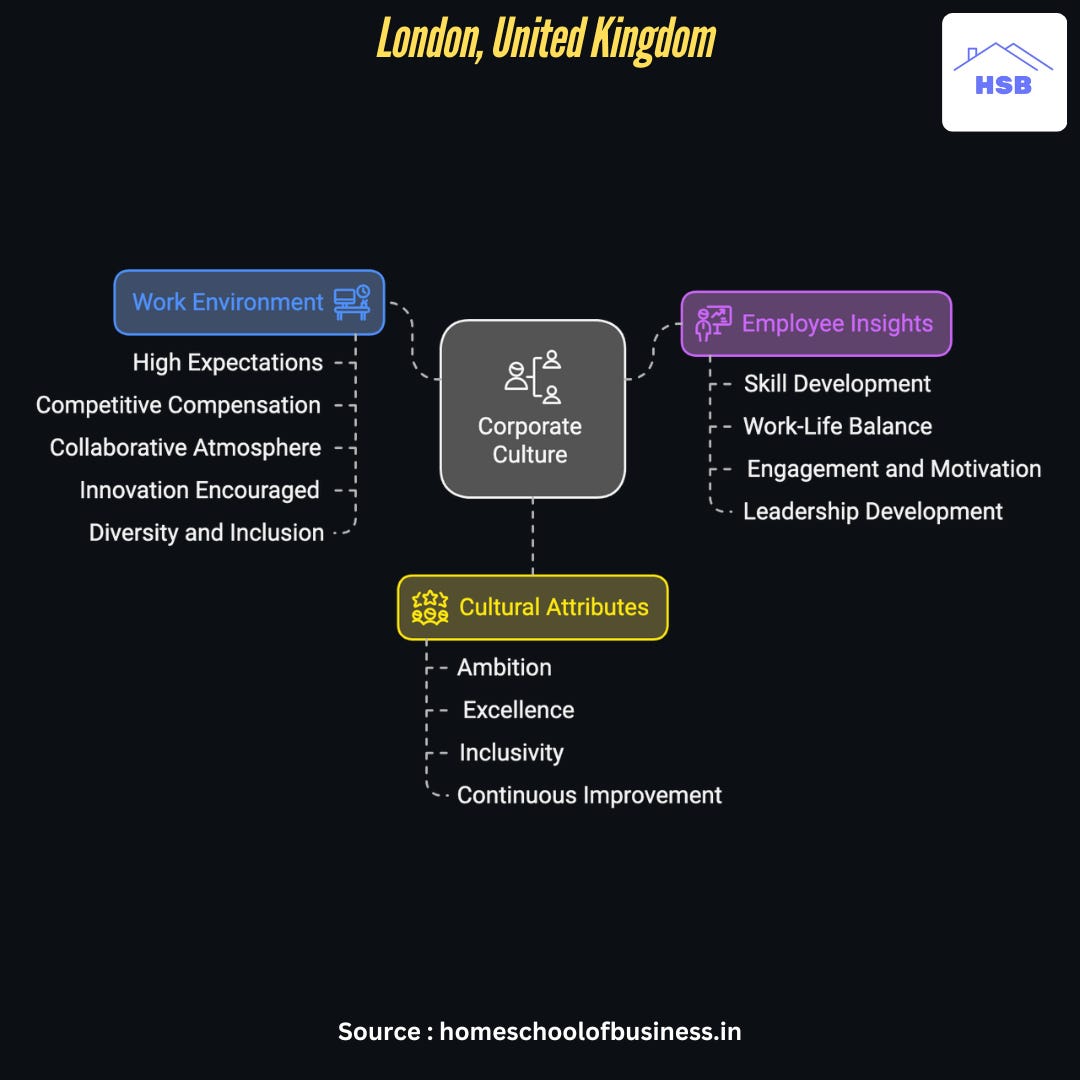

Corporate Culture and Employee Insights: Fostering Ambition and Excellence

London’s corporate culture is defined by its emphasis on ambition, innovation, diversity, and excellence. The city’s business environment fosters a competitive yet collaborative atmosphere, encouraging enterprises and employees to strive for success and continuous improvement.

Work Environment:

High Expectations: Businesses maintain high standards of performance, professionalism, and quality.

Competitive Compensation: Attractive salaries and benefits to attract and retain top talent.

Collaborative Atmosphere: Emphasis on teamwork, networking, and collaborative projects to achieve common goals.

Innovation Encouraged: Cultivating a culture of creativity and innovation, encouraging employees to develop and implement new ideas.

Diversity and Inclusion: Promoting a diverse and inclusive workplace, valuing different perspectives and backgrounds.

Employee Insights:

Skill Development: Opportunities for continuous learning, training, and professional growth.

Work-Life Balance: Emphasis on balancing professional responsibilities with personal well-being.

Engagement and Motivation: Initiatives to engage employees, recognize achievements, and foster a sense of belonging.

Leadership Development: Programs to develop leadership skills and prepare employees for managerial roles.

London’s corporate culture attracts a diverse and talented workforce, fostering an environment where employees can thrive and contribute to their organizations’ success.

Innovation and Research & Development: Driving the Future of Business

Innovation is a cornerstone of London’s business strategy, driving the future of various industries through continuous improvement, technological advancements, and creative solutions.

Technological Advancements:

Fintech Innovation: Pioneering developments in digital banking, blockchain technology, and financial automation.

Smart Cities: Implementing smart technologies in urban planning, transportation, and infrastructure management.

Artificial Intelligence: Leveraging AI for data analytics, customer service, and operational efficiency across sectors.

Green Technologies: Investing in renewable energy, sustainable materials, and eco-friendly processes to reduce environmental impact.

Research & Development Initiatives:

Tech Hubs and Incubators: Supporting startups and tech enterprises through incubators, accelerators, and innovation hubs.

Collaborations with Academia: Partnering with top universities and research institutions to drive cutting-edge research and innovation.

Government Grants and Incentives: Providing financial support and incentives for R&D projects and technological advancements.

Industry Partnerships: Facilitating collaborations between businesses, tech firms, and creative industries to foster innovation.

Future Projects:

Sustainable Infrastructure: Developing green buildings, renewable energy projects, and sustainable urban spaces.

Digital Transformation: Enhancing digital infrastructure and promoting the adoption of advanced technologies across industries.

Health and Wellness Technologies: Innovating in healthcare technologies, wellness services, and biotech sectors to improve quality of life.

Global Tech Expansion: Expanding London’s tech footprint internationally, establishing partnerships and ventures in emerging markets.

London’s commitment to innovation ensures that it remains at the forefront of industry trends, adapting to changing market dynamics and consumer preferences while driving economic growth and sustainability.

Social Responsibility and Sustainability: Committed to Positive Impact

London integrates social responsibility and sustainability into its business model, striving to make a positive impact on society and the environment through various initiatives and practices.

Corporate Social Responsibility (CSR) Initiatives:

Community Development: Supporting local communities through education programs, infrastructure projects, and social services.

Philanthropic Activities: Encouraging businesses to engage in charitable donations, sponsorships, and volunteer programs.

Diversity and Inclusion Programs: Promoting workplace diversity, gender equality, and inclusive hiring practices.

Ethical Business Practices: Ensuring transparency, accountability, and ethical conduct in business operations.

Sustainability Practices:

Eco-Friendly Construction: Utilizing sustainable building materials, energy-efficient designs, and green construction practices in real estate projects.

Renewable Energy Projects: Investing in solar, wind, and other renewable energy sources to reduce carbon footprints.

Waste Reduction and Recycling: Implementing comprehensive waste management, recycling programs, and circular economy initiatives.

Sustainable Transportation: Promoting the use of public transportation, electric vehicles, and cycling infrastructure to reduce emissions.

Green Finance: Encouraging investment in sustainable projects and providing financial products that support environmental goals.

London’s focus on social responsibility and sustainability reflects its commitment to ethical business practices and contributing positively to the communities it serves and the environment.

Customer Engagement and Community Building: Building Lasting Relationships

London prioritizes building strong relationships with customers and communities through personalized interactions, active engagement, and strategic community initiatives.

Customer Relationships:

Personalized Services: Offering tailored services and experiences to meet individual customer needs and preferences.

Feedback Mechanisms: Actively seeking and incorporating customer feedback to improve products and services.

Loyalty Programs: Implementing loyalty programs to reward repeat customers and foster long-term relationships.

Customer Support: Providing exceptional customer service and support to ensure satisfaction and retention.

Community Involvement:

Local Partnerships: Collaborating with local businesses, organizations, and community groups to support initiatives and economic growth.

Philanthropic Efforts: Engaging in charitable activities, donations, and support for social causes and community projects.

Event Sponsorships: Sponsoring local events, cultural activities, and business forums to enhance community engagement and brand presence.

Educational Programs: Supporting education and training programs to develop skills and opportunities within the community.

London’s commitment to customer engagement and community building strengthens its reputation, fosters loyalty among customers, and enhances its standing as a socially responsible and community-focused city.

Challenges and Opportunities: Navigating a Dynamic Market

Despite its successes, London faces several challenges and opportunities as it continues to expand and innovate in a dynamic global market.

Current Challenges:

Brexit Implications:

Impact: Changes in trade agreements, regulatory frameworks, and talent mobility affecting businesses and economic stability.

Market Volatility:

Impact: Fluctuations in financial markets can impact investment and economic confidence.

Cost of Living:

Impact: High living costs can affect workforce availability, business expenses, and overall economic inclusivity.

Regulatory Changes:

Impact: Shifts in financial regulations, data protection laws, and environmental standards influencing business operations.

Global Competition:

Impact: Increasing competition from other global financial and tech hubs challenging London’s dominance.

Future Opportunities:

Global Expansion:

Opportunity: Expanding into emerging markets with high growth potential in finance, technology, and real estate.

Technological Integration:

Opportunity: Adopting advanced technologies such as artificial intelligence, blockchain, and IoT to enhance operational efficiency and customer experiences.

Sustainability Initiatives:

Opportunity: Increasing focus on sustainable building practices, renewable energy projects, and green finance to attract environmentally conscious investors and consumers.

Diversification:

Opportunity: Exploring new business verticals, such as healthtech, edtech, and green technologies, to diversify revenue streams and reduce dependency on traditional sectors.

Talent Development:

Opportunity: Investing in education, training, and talent retention strategies to build a skilled and innovative workforce.

By addressing these challenges and capitalizing on emerging opportunities, London can continue to thrive in a competitive and evolving market landscape.

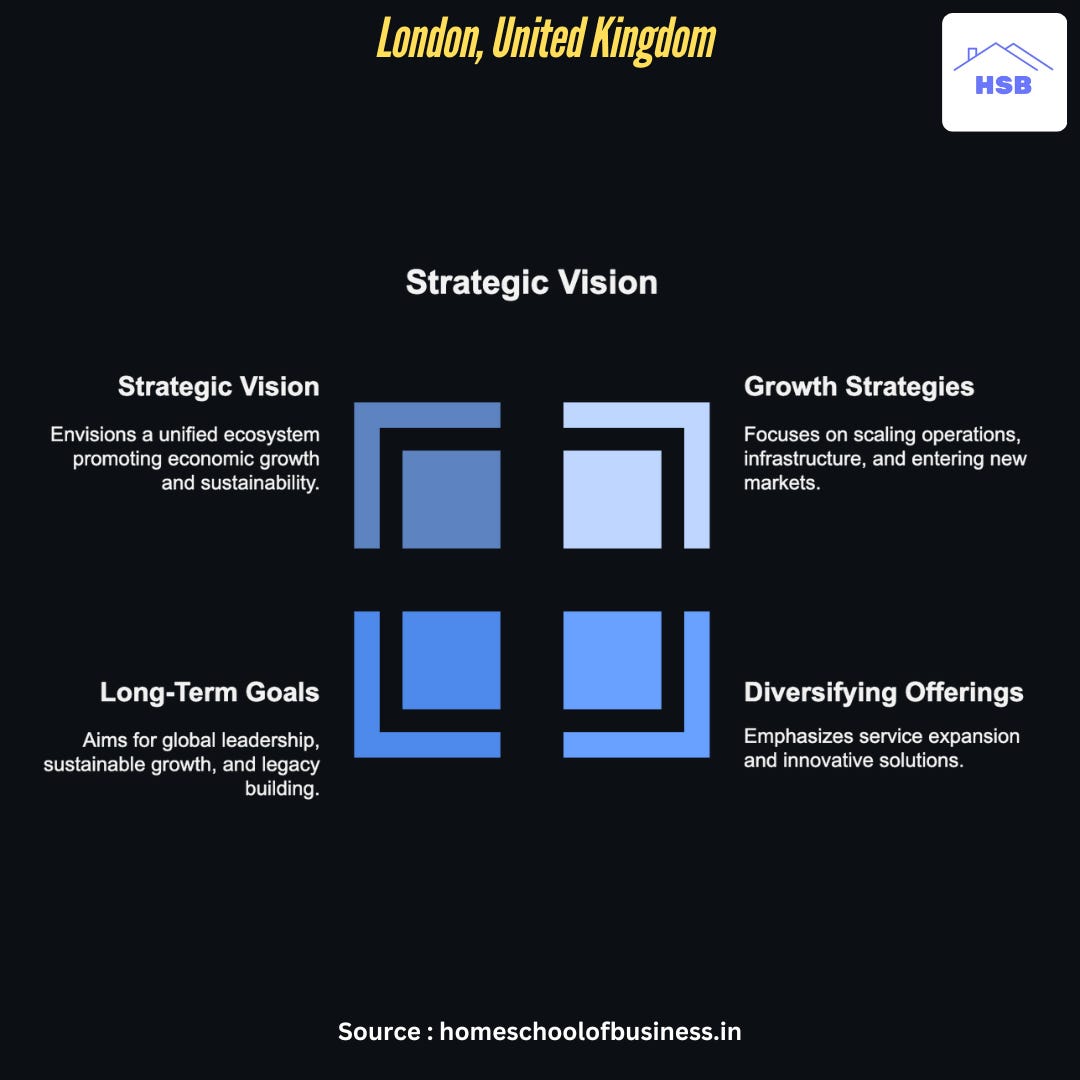

Future Plans and Strategic Vision: Shaping the Future of Business

London’s strategic vision focuses on sustained growth, innovation, and expanding its business landscape to meet evolving global demands and trends.

Growth Strategies:

Scaling Operations:

Expansion: Increasing the presence of financial institutions, tech startups, and creative enterprises across the city.

Infrastructure Development: Upgrading transportation, digital infrastructure, and public services to support business growth and quality of life.

Entering New Markets:

International Expansion: Establishing partnerships and ventures in emerging global markets to replicate London’s success abroad.

Sectoral Growth: Expanding into high-growth sectors such as green finance, healthtech, and sustainable real estate.

Diversifying Offerings:

Service Expansion: Launching new financial products, technological solutions, and creative services to diversify revenue streams.

Innovative Solutions: Developing cutting-edge solutions in fintech, AI, and sustainable technologies to stay ahead of market trends.

Long-Term Goals:

Global Leadership:

Objective: Establishing London as a leading global brand in finance, technology, and creative industries.

Strategy: Enhancing global partnerships, attracting top talent, and fostering innovation ecosystems.

Sustainable Growth:

Objective: Ensuring economic growth is achieved through sustainable and ethical business practices.

Strategy: Promoting green initiatives, investing in renewable energy, and implementing eco-friendly policies.

Innovative Solutions:

Objective: Continuously developing innovative solutions to enhance customer experiences and operational efficiency.

Strategy: Investing in R&D, embracing digital transformation, and fostering a culture of creativity and experimentation.

Legacy Building:

Objective: Creating a lasting legacy through impactful projects, community contributions, and sustainable business practices.

Strategy: Engaging in long-term projects that benefit society and the environment, and supporting future generations through education and philanthropy.

London’s long-term vision encompasses a future where the city seamlessly integrates financial prowess, technological innovation, and creative excellence into a unified ecosystem that drives global economic growth and sustainability.

Building a Similar Brand: Roadmap for Aspiring Entrepreneurs

For those inspired by London’s success and aiming to build a similar dynamic and influential brand, the following roadmap outlines key steps and strategies:

1. Develop a Clear Mission and Vision:

Define Core Purpose: Establish the fundamental purpose of your business.

Set Long-Term Goals: Align your long-term objectives with your mission to guide strategic decisions.

2. Focus on Quality and Consistency:

High-Quality Offerings: Ensure your products and services meet high standards of quality.

Standardized Processes: Implement consistent processes across all operations to maintain reliability.

3. Implement Scalable Systems and Processes:

Efficient Operations: Develop operational systems that can be easily replicated and scaled.

Invest in Technology: Utilize technology to streamline operations and enhance customer experiences.

4. Adopt a Scalable Business Model:

Franchising or Licensing: Consider models that facilitate rapid expansion without significant capital expenditure.

Adaptability: Ensure your business model can adapt to different markets and scales effectively.

5. Invest in Marketing and Brand Building:

Strong Brand Identity: Create a brand identity that resonates with your target audience.

Diverse Marketing Channels: Utilize various marketing channels, including digital platforms, to build brand awareness.

6. Embrace Innovation:

Continuous Innovation: Regularly develop new products and services to stay ahead of market trends.

R&D Investment: Invest in research and development to enhance your offerings and operational efficiency.

7. Commit to Customer Satisfaction:

Prioritize Feedback: Listen to customer feedback and continuously improve based on their needs.

Excellent Service: Foster strong customer relationships through exceptional service and engagement.

8. Build a Strong Supply Chain:

Reliable Partnerships: Develop strong partnerships with suppliers to ensure consistent quality and availability.

Optimize Supply Chain: Streamline your supply chain to reduce costs and enhance efficiency.

9. Focus on Operational Excellence:

Maximize Efficiency: Streamline operations to maximize productivity and minimize waste.

Best Practices: Implement industry best practices in management and operations to drive success.

10. Ensure Sustainable Practices:

Eco-Friendly Operations: Adopt sustainable practices to minimize your environmental footprint.

Promote Sustainability: Make sustainability a core value to attract environmentally conscious consumers.

11. Cultivate a Positive Corporate Culture:

Inclusive Environment: Foster an inclusive and collaborative work environment.

Employee Development: Invest in training and development to build a motivated and skilled workforce.

12. Adapt to Market Dynamics:

Stay Informed: Keep abreast of changing market trends and consumer preferences.

Agility: Be prepared to pivot your strategies to meet evolving demands.

By following this roadmap, aspiring entrepreneurs can emulate London’s success, building a brand that combines business acumen with a mission-driven approach to create lasting value and impact.

Industry Trends and Company Adaptation: Staying Ahead of the Curve

The real estate, financial services, technology, and creative industries in London are constantly evolving, influenced by technological advancements and changing consumer behaviors. London’s adeptness at adapting to these trends has been crucial in maintaining its competitive edge.

Market Trends:

Digital Transformation:

Integration: Increasing reliance on digital platforms for financial services, property listings, virtual tours, and online transactions.

Innovation: Adoption of fintech solutions, blockchain technology, and AI-driven analytics.

Sustainability Focus:

Demand: Growing demand for eco-friendly and sustainable buildings, renewable energy projects, and green finance.

Regulations: Stricter environmental regulations encouraging sustainable business practices.

Smart Technologies:

Implementation: Integration of smart home technologies, automation in real estate, and smart infrastructure in urban planning.

Enhancements: Use of IoT, AI, and big data to enhance operational efficiency and customer experiences.

Health and Wellness:

Focus: Rising interest in wellness-focused amenities and environments in real estate and hospitality services.

Innovation: Development of health-centric spaces, wellness programs, and sustainable living environments.

Personalization:

Trend: Consumers seeking personalized and customized experiences in both financial services and real estate.

Solutions: Use of data analytics and AI to tailor services and products to individual preferences and needs.

Strategic Adjustments:

Technological Integration:

Adoption: Implementing advanced technologies to enhance operational efficiency and customer experiences.

Investment: Investing in digital infrastructure, AI, and blockchain to stay ahead of technological trends.

Sustainable Practices:

Implementation: Adopting green building practices, renewable energy projects, and sustainable business operations.

Commitment: Committing to environmental sustainability to meet consumer demand and regulatory requirements.

Diversified Offerings:

Expansion: Expanding service offerings to include wellness amenities, personalized financial products, and innovative real estate solutions.

Innovation: Continuously developing new products and services to cater to evolving consumer preferences.

Market Expansion:

Geographic: Entering new geographic markets and diversifying into related business sectors to capture emerging opportunities.

Sectoral: Expanding into high-growth sectors such as green finance, healthtech, and sustainable real estate.

London’s proactive approach to industry trends ensures that its economy remains relevant and competitive in a rapidly changing global market landscape.

Conclusion: A Multifaceted Legacy Ahead

London’s relentless pursuit of economic excellence, strategic vision, and ability to navigate complex global landscapes have positioned it as a formidable figure in the realms of finance, technology, real estate, and creative industries. With a clear mission, strong leadership, and a commitment to expanding its business ventures, London continues to influence various sectors and global economic discourse.

As London’s economy evolves, it remains dedicated to fostering financial innovation, providing cutting-edge technological solutions, and nurturing creative enterprises through strategic initiatives. London’s legacy is not just one of economic triumphs, but also of shaping the dynamics of global finance, technology, and cultural industries in the modern era.

London exemplifies how a combination of strategic vision, adaptability, and a commitment to excellence can create a lasting impact across multiple sectors. As the city continues to innovate and expand, it stands as a testament to what can be achieved when a global metropolis aligns its mission with sustained economic growth and societal progress.

London’s journey underscores the importance of strategic leadership, innovation, and resilience in building and sustaining a successful and influential global economy. Whether through financial prowess, technological advancements, or cultural contributions, London’s multifaceted legacy continues to shape industries and inspire aspiring entrepreneurs and business leaders worldwide.

HSB Important Articles and References :Share your feedback and tell us which case studies you'd like to see next by filling out this quick Google form! Click Here

Check and follow up:

1) WhatsApp Channel : Click Here

2) Instagram : https://www.instagram.com/homeschoolofbusiness.in/

Did you know the History of London?

Did you know this about London?

Top Universities in London

Properties to Rent in London

7 Traditional British Dishes to try in London

Best Restaurants to visit in London

Top 50 Things to do in London

Top 30 Places to Visit in London

100 Famous British People

London Business Plans & Investments until 2033 by Mayor of London

Transport in London

Top Companies in London

The Economy of London

Largest Companies in london

HSB Video Vault :-

The Home School of Business WEBSITE

Best Regards,

The Home School of Business Team